Best Prepaid Forex Card India

Are you planning to travel away? Don't you discover information technology difficult to manage your expenses on your overseas trips? If your reply is yeah, nosotros're hither with a quick solution- the forex carte du jour. If you love travelling, a forex card is a must-take for yous.

It allows us to behave any currency of our choice and makes the payment process shine and comfy for u.s.. Just like whatsoever other debit/credit card, with forex cards, you lot can withdraw cash from an ATM. This article suggests the all-time forex cards in Bharat, to make yous travel free from whatsoever hassle and worries.

Making your traveling experience smooth allows you to pay on your bus or train tickets, taxi fares, restaurant bills, shopping, and many more with a simple swipe of your carte du jour.

What Is A Forex Card?

A Forex card, as well known as a prepaid carte, prepaid travel money card, or travel money card, is one of the safest and cheap ways of conveying money while traveling to another state. Information technology is 1 of the nearly accepted ways of carrying strange currency, therefore information technology's like a approval to all the travelers.

Forex card is a type of prepaid credit carte du jour which allows you to deposit funds in foreign currency every bit per your preference based on the state yous will exist visiting. Yous tin merely pay directly through the card or you can even withdraw cash from the ATMs. You don't need to worry about conveying money everywhere and this option is much safer.

Types of Forex Cards In India?

There are various types of Forex cards but are distinctly divided into two main categories. The two principal categories of Forex cards in Republic of india are every bit follows:

Single Currency Forex Cards

As the name suggests, unmarried currency forex cards are the one which can just exist loaded with a unmarried currency, which tin can be reloaded as many times as the user wants. This unmarried currency card has a high-cross currency charge whenever the users use dissimilar currency and consist of limited benefits.

Multi-Currency Forex Card

With multi-currency forex cards, users tin preload the card with multiple currencies, depending on the blazon of card they have called.

The Banks, fiscal institutions, and travel agencies offering the applicants the choice depending on the currency they desire to load in their respective cards. A menu that consists of 23 unlike currencies can be used all over the world. It provides some additional cost benefits to its users besides.

Various other forex cards are also being introduced with their unique features similar the Student Forex cards for students who accept an interest in traveling abroad as well as the Contactless Forex cards that assistance the users to pay at the retail outlets in a much safer way. Accordingly, people should go for forex cards which do good them as per their requirements.

10 Best Forex Cards in India

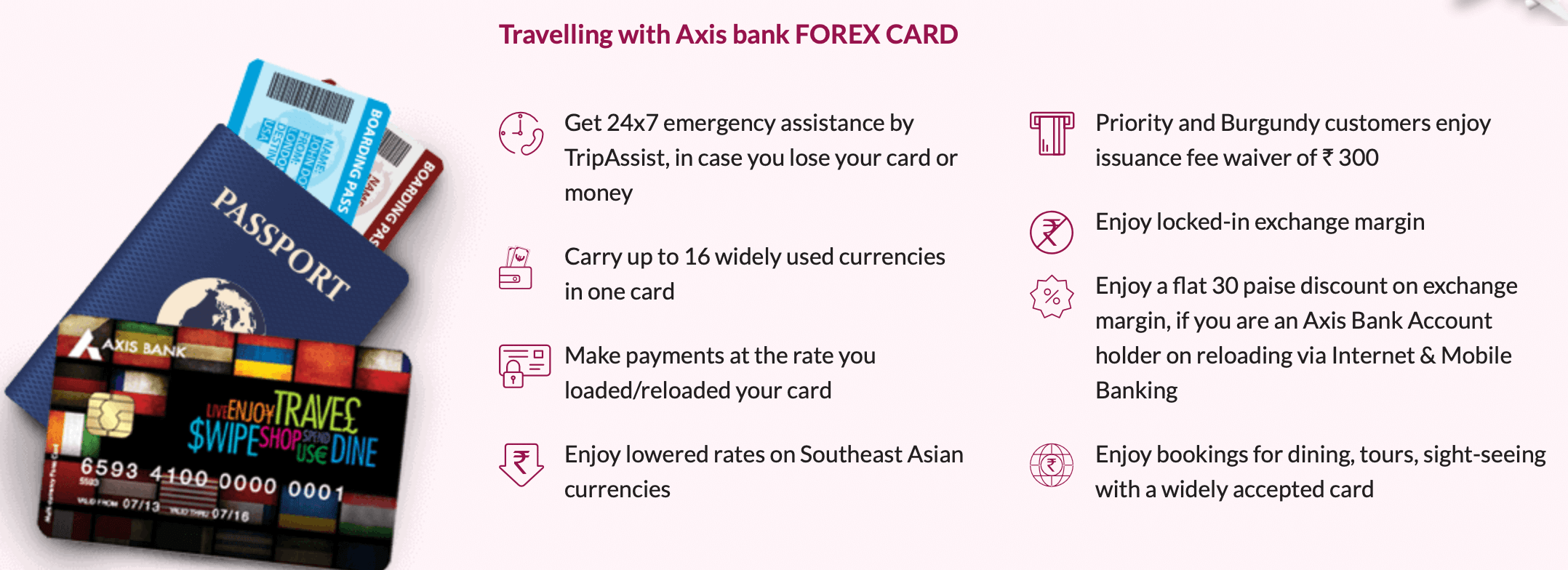

1. Axis Bank Multi-Currency Forex Card

Axis Banking company Multi-Currency Forex Card is one of the best forex cards in Bharat, it helps the applicants every bit they don't necessarily need to reload their cards with different currencies every time they travel to a new destination. This card also protects from currency fluctuations.

This carte even helps y'all encash your money one time you finish the trip. With the help of contactless technology, the users don't need to have any contact and tin hands pay by merely waving the carte du jour across the contactless reader.

There is besides a role provided like an Image Forex card where the bidder can add an image to their cards, it can be their personalized picture or even some offered by Axis Bank.

The currencies that can be loaded are as follows:

USD, Euro, British Pound, Singapore Dollar, Australian Dollar, Canadian Dollar, Japanese Yen, Swedish Krona, Thai Baht, United Arab Emirates Dirham, Saudi Riyal, Hong Kong Dollar, New Zealand Dollar, Danish Krone, S African Rand.

Fees:

- Initial Insurance Fees: Rs 300 plus GST

- Reload: Rs 100

- The Reactive Fee: Rs 100.

- Cantankerous-Currency Charges: 3.v%

- The Validity of these cards is up to 5 Years.

ii. YES Bank Multi-Currency Travel Menu

Yes Bank Multi-Currency Travel Card is too one of the best forex cards in India because it is highly secured and cost-efficient. The good affair is that you lot can easily manage this card from anywhere and at any fourth dimension from the customer care portal online. You lot can also detect your previous transaction.

The currencies that tin be loaded are as follows:

USD(United States Dollar), GBP (British Pound), EUR (Euro), SGD (Singapore Dollar), AUD (Australian Dollar), AED (UAE Dirhams), JPY (Japanese Yen), CAD (Canadian Dollar), HKD (Hong Kong Dollar), CHF (Swiss Franc)

Fees :

Insurance Fees: Rs 125

Reload: Rs 100

Validity: 2 Years and during this time users can reload information technology every bit many times as they desire.

Also Read: x Best Credit Cards for Online Shopping

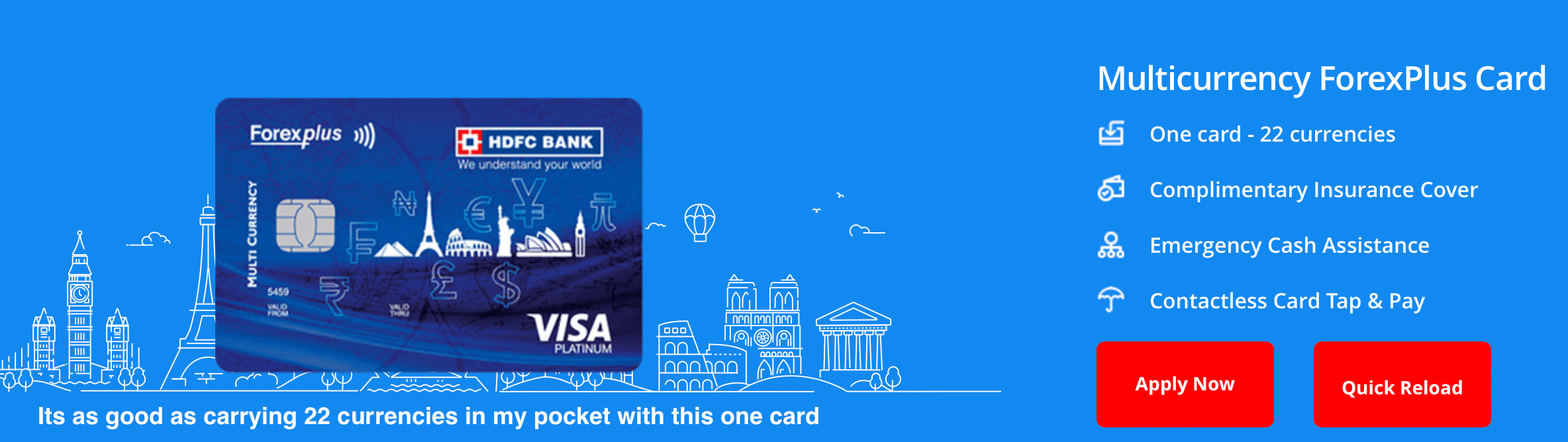

3. HDFC Multi-Currency Forex Card In India

HDFC Multi-Currency Forex card is one of the about popular in the market. It offers almost 22 currencies nether a single menu.

These cards provide features like shuffle funds between two different currencies and it is contactless with additional insurance coverage and concierge services. In improver, they also protect users from forex currency fluctuations.

Customers as well become compensation up to Rs v lakhs to protect them from whatever misuse.

The currencies that can be loaded are as follows:

US Dollar, New Zealand Dollar, Kuwait Dinar, Australian Dollar, Hong Kong Dollar, Qatari Riyal, Canadian Dollar, Singapore Dollar, Bahrain Dinar, Euro, Sultanate of oman Riyal, Korean Won, UAE Dirhams, Japanese Yen, Saudi Riyal, Sterling Pound, Malaysian Ringgit, Norwegian Krone, Swiss Franc, Thailand Baht, Danish Krone, Swedish Krona, South African Rand

Fees:

Issuance Fee: Rs 500 plus GST

Reload Fee: Rs 75 plus GST

Reactive fee: Rs 100

Cantankerous currency charges: 2%

4. Indusind Banking concern Multi-Currency Forex Card In India

Indusind Bank Multi-Currency Card is famous amongst those who travel abroad frequently. This card offers fourteen different currencies with add-on features like zero foreign markup rates and the fact that it can be operated online. Information technology provides boosted benefits like customers can become up to ii free ATM withdrawals per calendar month.

The currencies that can be loaded are as follows:

United states of america Dollar (USD), Canadian Dollar (CAD), Australian Dollar (AUD), Saudi Riyal (SAR), Euro (EUR), Singapore Dollar (SGD), British Pound (GBP), United Arab Emirates Dirham (AED)

Fees:

Issuance Fee (single bill of fare): Rs.150 plus GST

Issuance fee (paired card): Rs 250

Reload Fee: Rs.100 plus GST

Cross Currency Charges: iii.5%

v. Thomas Cook Forex Carte du jour In India

Thomas Melt is one of the pop travel companies that likewise offering forex cards in India. With their card you can even send money abroad, they offer 9 different currencies. It is a trusted brand and provides insurance coverage of about $10000. In addition, features include toll-free customer service, which is available on online platforms helping in checking balance, statements, and blocking cards.

The Currencies That Tin can Be Loaded Are Equally Follows:

United states of america Dollars, Euro, Australian Dollars, British Pounds, Swiss Francs, Canadian Dollars, Singapore Dollars, Japanese Yen

Fees:

Issuance Fee: Rs.150 plus GST

Reload Fee: Rs.100 plus GST

6. ICICI Banking company Forex Prepaid Cards

ICICI Banking concern Forex Prepaid Card is a corking choice if you desire to travel to a specific location or destination. It is flexible to work with your travel plans. You can reload this carte at any ICICI forex branches, their online platform, or even their iMobile application.

Moreover, it provides additional benefits like 20% discounts on restaurant bills, shopping, and various other outlets worldwide. They as well provide insurance cover upward to Rs 10,00,000. No savings or current accounts are required with ICICI banking concern to open this account and they even deliver the carte in merely 2 days.

The Currencies ICICI Forex Card offers to load different currencies:

US Dollar (USD), Singapore Dollar (SGD), British Pound (GBP), Australian Dollar (AUD), Arab Emirates Dirham (AED), Canadian Dollar (CAD), Euro (EUR), Swiss Franc (CHF), Japanese Yen (JPY), Swedish Krona (SEK), South African Rand (ZAR), Saudi Riyal (SAR), Thai Baht (THB), New Zealand Dollar (NZD), Hong Kong Dollar (HKD)

Fees & Charges:

Issuance Fee: Rs 150 (1 time)

Reload Fee: Rs 100

Reactive Fee: USD v (for every 180 days of inactivity)

Cross Currency Fee: 3.5%

Also Read: Top 10 International Banks in Republic of india

7. SBI Multi-Currency Foreign Travel Card

SBI Multi-Currency Strange Travel Bill of fare is one of the safest and wise options when it comes to forex cards in India. Information technology can be loaded with seven currencies from different countries. Y'all tin utilise information technology for many payments like for eating place bills, shopping, dining, and other adaptation bills worldwide every bit it consists of the MasterCard Acceptance Mark. It is available 24/7 worldwide.

The Currencies That Can Be Loaded Are As Follows:

U.s. Dollars (USD), Pound Sterling (GBP), Euro (EUR), Canadian Dollar (CAD), Australian Dollar (AUD), Japanese Yen (YEN), Saudi Riyal (SAR), Singapore Dollar (SGD)

Fees:

Insurance Fees: Rs 100 plus GST

Add together-on Fees: Rs 100 plus GST

Reloading Fees: Rs 50 plus GST

eight. Axis Bank Diners Bill of fare

Centrality Bank Diner cards only allow the applicants to load USD. They provide gift cards that give you ii points every fourth dimension you buy upwards to 5 USD. Moreover, its boosted benefits consist of medical treatment and ATM robbery for up to Rs threescore,000.

Users are free to encash their residue to their domestic accounts.

Fees:

Card Activation Accuse: Rs150 plus GST

Reload fee: Rs 100 plus GST

Addition Carte du jour Fee: Rs 100 plus GST

9. HDFC Banking concern ISIC Pupil ForexPlus Card

HDFC Depository financial institution ISIC Student ForexPlus Carte du jour was introduced for students as its name suggests and helps with the student identity card. It comes with boosted benefits as well as discounts in effectually 130 countries for books, travel expenses, and many more. The baggage loss charges are almost Rs l,000 and passport reconstruction covers up to Rs 20,000. In addition, Customers become benefits like complimentary complimentary international SIM with a talk fourth dimension of Rs 200 and it can be excessed 60 days earlier the day of travel.

The Currencies That Can Be Loaded Are As Follows:

USD, Euro, and Sterling Pounds

Fees:

Card Issuance Fees: Rs 300

Reload Fees: 75

Re-issuance Fees: Rs 100

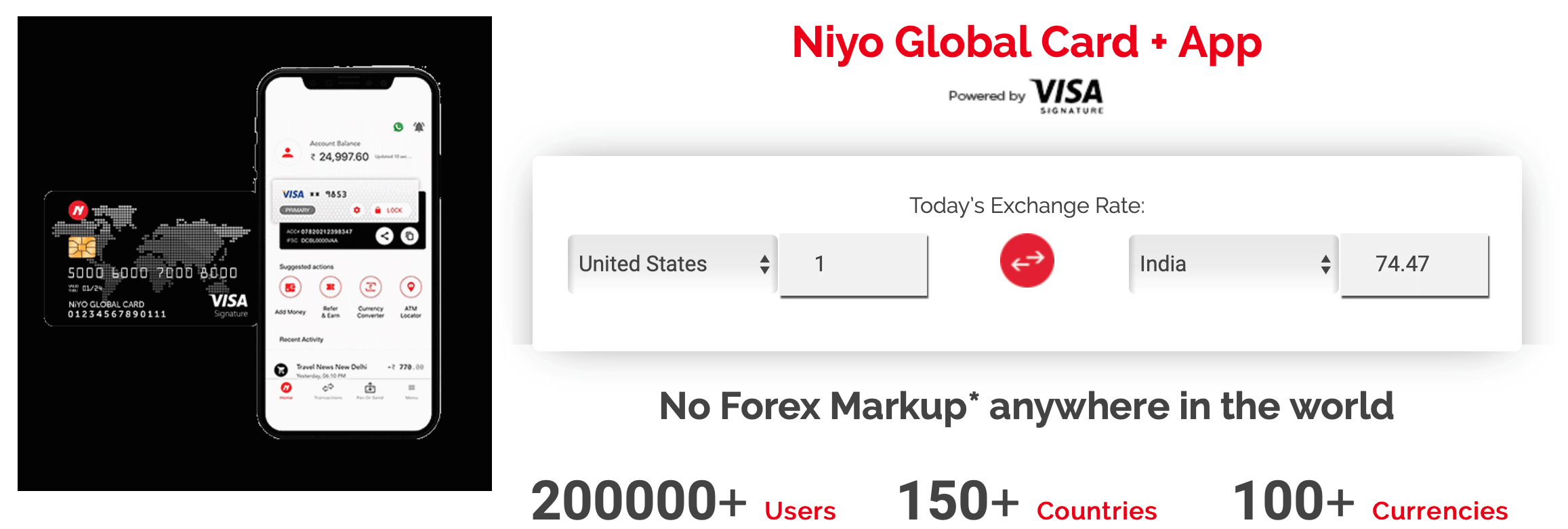

x. Niyo Global Card

Niyo Global Card is the best and most famous forex carte as reviewed by i of the leading travelling companies. This is issued with the cooperation of DCB Banking company. Moreover, information technology tin be easily operated by their mobile application, you can fifty-fifty lock the carte du jour if information technology'due south not in utilise.

Fees:

Joining Fees and Renewal Fees: Zero

ATM Withdrawal: Zero

Also Read: Top 15 Best Debit Cards in Bharat

Best Forex Cards in Bharat – Comparision

| Sr. No. | Card | Initial Insurance Fee (in Rs) | Reload Fee | Boosted Benefits |

| 1 | Axis Bank Multi-Currency Forex Menu | 300 plus GST | 100 (₹) | Protects from currency fluctuation.You can encash your money at your inflow. Contactless technology and Image Forex carte du jour features are as well bachelor. |

| 2 | Yep Bank Multi-Currency Travel Forex Card | 125 | 100 (₹) | Highly secured and toll-efficient.Tin be operated at whatsoever time and everywhere with their online portal. |

| 3 | HDFC Multi-Currency Forex Bill of fare | 500 plus GST | 75 (₹) plus GST | Shuffle funds between two different currencies,Information technology is contactless with boosted insurance coverage and concierge service.Also protects from currency fluctuations. |

| 4 | IndusInd Bank Multi-Currency Forex Card | 150 (single) 250 (paired)(plus GST in both) | 100 (₹) plus GST | Customers get 2 free ATM withdrawals per calendar month.Applicative for 14 currencies with add-on features like zero strange markup rates.It can be operated online and is good for people who travel ofttimes. |

| 5 | Thomas Cook Forex Card | 150 plus GST | 100 (₹) plus GST | Yous tin fifty-fifty send money abroadThey offer 9 different currencies.toll-free customer service, which is available on online platforms helping in checking residual, statements, and blocking cards. |

| 6 | ICICI Bank Forex Prepaid Card | 150 (ane time) | 100 (₹) | It is people who desire to travel to a specific location.You can reload this card at any ICICI forex branches, their online platform, or fifty-fifty their iMobile application.Provides 20 % discounts on the eating house bills, fares, dining expenses, etc. |

| 7 | SBI Multi-Currency Foreign Travel Menu | 100 plus GST | 50 (₹) plus GST | It tin be loaded with seven currencies from different countries. You can make many payments like for eatery bills, shopping, dining, and other adaptation bills worldwide as it consists of the MasterCard Acceptance Marking. It is available 24/seven worldwide |

| eight | Axis Banking concern Diner Menu | 150 plus GST | 100 (₹) plus GST | Only allow the applicants to load USD. They provide gift cards that requite y'all 2 points every time you purchase up to 5 USD. Its additional benefits consist of medical handling and ATM robbery for upwardly to Rs threescore,000. |

| ix | HDFC Banking concern ISIC Pupil ForexPlus Card | 300 | 75 (₹) | It helps with the educatee identity card. Customers get gratis gratis international SIM with a talk fourth dimension of Rs 200 and it can be excessed 60 days earlier the day of travel.Provides discounts in around 130 countries for books, travel expenses, and other expenses.The baggage loss charges are nigh Rs 50,000 and passport reconstruction covers upward to Rs 20,000. |

| 10 | Niyo Global Menu | NA | NA | This is issued with the cooperation of DCB Bank. Moreover, it tin be easily operated by their mobile application, you tin can even lock the card if it's not in use. |

Also Read: Top viii Best Credit Cards in India

Last Thoughts

Forex cards in India are gaining more and more popularity with the changing times. A forex card is like a approval for all travellers, rendering them a cost-effective mode of making payments flexibly and effortlessly. With their boosted benefits, information technology'due south like a deal that shouldn't exist missed if you lot're a travel enthusiast and love travelling. In conclusion, making your travelling experience blissful and as per your requirements similar a single currency menu if yous want to travel to one land and multi-currency forex cards for unlike countries and addition benefits.

Frequently Asked Questions

What tin exist the minimum corporeality for loading my forex card?

Information technology depends on the cardholder every bit well as which card is issued.

What can be the minimum amount for loading my forex bill of fare?

Forex cards are more profitable and competitive for international travel. It is widely accepted and also saves conversion fees.

Can I reload my card from overseas?

No, you can not reload your card from overseas as most companies don't let that simply instead you can assign 1 person to refill your carte on your behalf.

How tin can I withdraw money using a Forex card?

You lot can withdraw money simply past visiting any ATM and choose the 'credit card' option every bit the type of card. After that, you only have to follow the instructions mentioned on the screen.

Best Prepaid Forex Card India,

Source: https://wealthquint.com/best-forex-cards-in-india-9386/

Posted by: windsorwhock2002.blogspot.com

0 Response to "Best Prepaid Forex Card India"

Post a Comment