jared wesley book 2019 professional trading strategies

Trend Line is incomparable of the most mobile tools in trading.

You can use it in day trading, swing trading or even position trading.

However, most traders get it wrong.

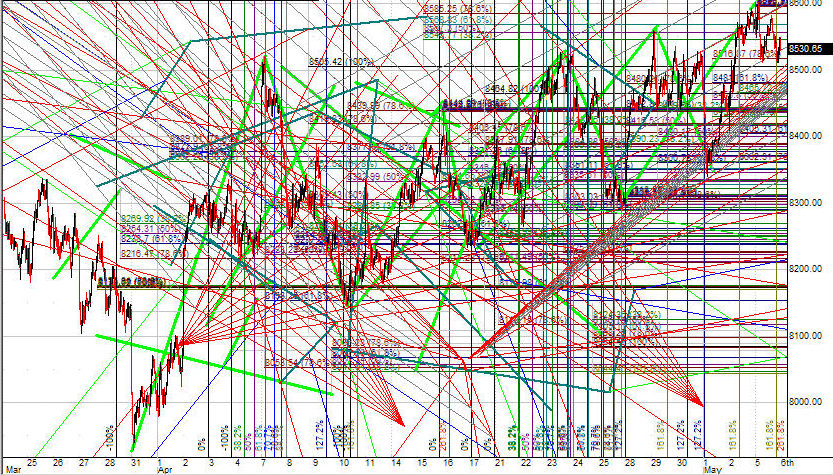

They draw Trend Lines looking comparable this…

I know I'm exaggerating, but you mystify my point.

That's wherefore in today's post, you'll find out:

- What is a Trend Line and how does it crop

- How to draw a Trend Line correctly (that almost traders never find out)

- How to use Trend Line to identify the counseling of the trend — and tell when the market condition has altered

- How to use Trend Air to better time your entries

- The Trend Line Breakout strategy

- How to ride massive trends using a simple Trend Line proficiency

- How to use Trend Line and identify trend reversal

Or if you prefer, you can take in this training downstairs…

What is a Trend Line you bet does IT work

You have it off Livelihood and Resistance are naiant areas on your chart that shows potential buying/marketing pressure.

And information technology's the same for Trend Telephone line.

The only difference is… a Trend Line isn't horizontal but sloping.

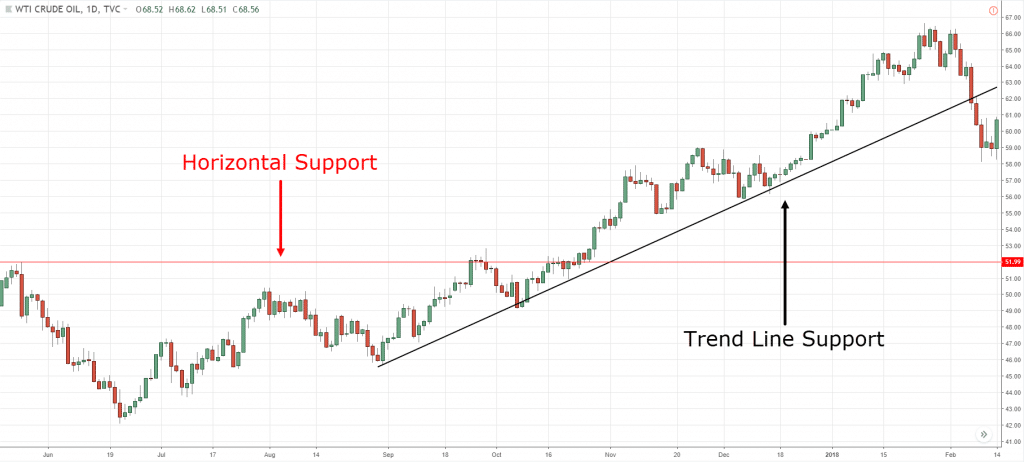

Here's a Trend Line example:

Thus here's my definition of it:

Upward Trend Line: "Sloping" area on the graph that shows upward purchasing pressure.

Downward Style Line: "Sloping" area on the chart that shows downward selling pressure.

Now before I dive into specific Trend Line strategies and techniques, you moldiness first learn how to draw a Trend Line correctly.

And that's what I'll hatch next.

So read on…

How to Draw a Trend Line aright

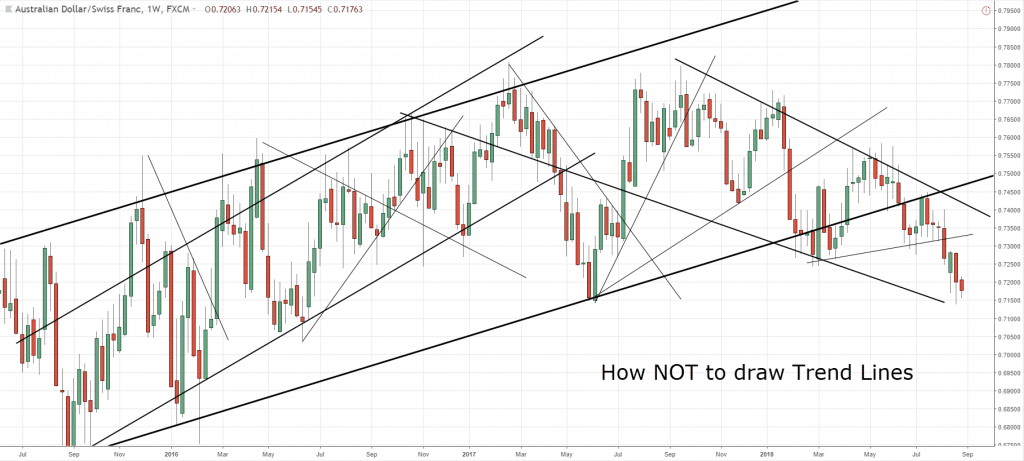

First, let's learn how NOT to draw your Trend Demarcation.

Present's a bad example:

Clearly, this is drivel.

How do you know which Trend Lines are valuable? And which to ignore?

You've no idea.

So mind carefully:

Here's how to draw a Trend Line aright…

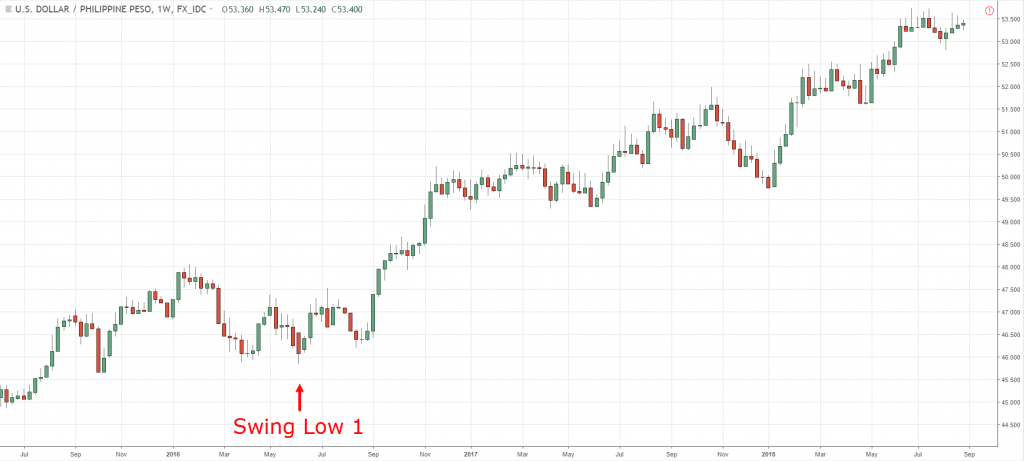

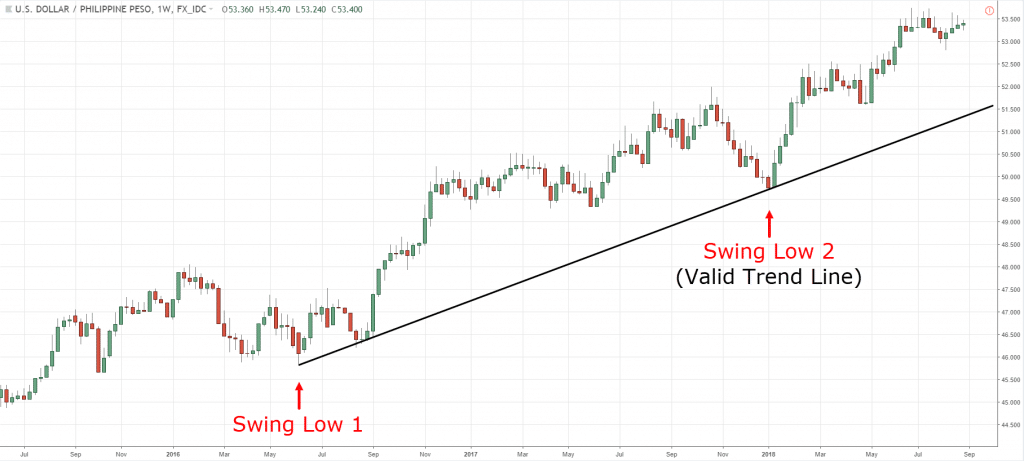

- Nidus lone on the major swing points and ignore everything else

- Tie at any rate 2 major golf stroke points

- Adjust it so that you get the most number of touches (whether information technology's body Oregon wick)

Here's a Trend Line example:

Favoring Tip:

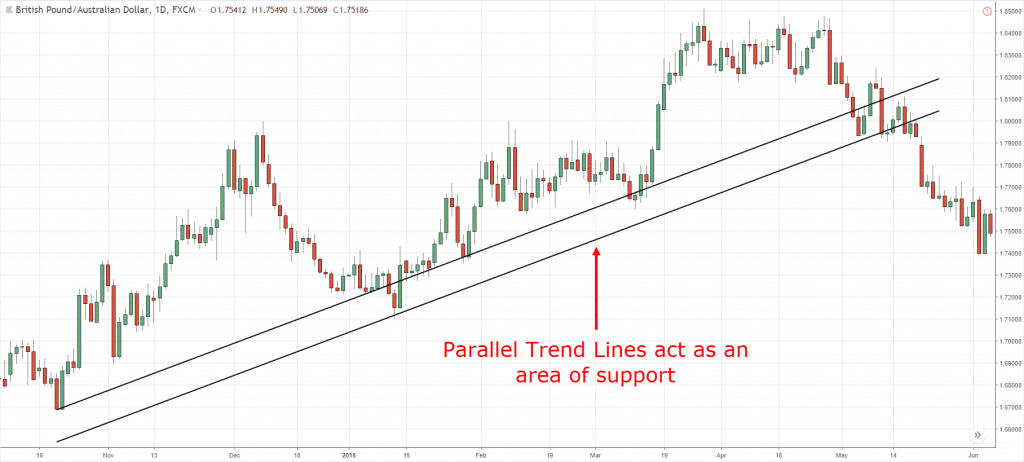

You can draw 2 synchronic Trend Line to define the area on your chart.

Here's an example…

Directly…

Different Support and Resistance where you can just quarter once and bequeath information technology, Curve Line needs "adjustment".

This happens when the price breaks the Trend Line then recovers — and you need to "adjust" the Curve Business to fit the recent price action.

Moving on:

You'll learn how Trend Lines bathroom improve your trading results…

How to use Trend Transmission line to identify the direction of the trend — and recite when the market condition has denaturised

Wholly you take to do is draw your Style Line and ask yourself…

"Is the Trend Ancestry pointing higher or let down?"

If IT's high, so the market is in an uptrend (and contrariwise).

An example:

But that's not totally.

Because a Trend Line give the axe also alert you when market conditions are changing.

How?

Past paying attention to the steepness of the Trend Line.

For example:

If your Trend Line is getting flatter, it means the market is moving into a straddle condition.

And if your Trend Rail line is getting steeper, it means the veer is becoming stronger (or possibly going into a buying orgasm).

Is this consequential?

Heck yes!

Because if you know market conditions are changing, you can set your trading scheme accordingly.

And not use the same "trick" for all market conditions — which is a recipe for disaster.

Next…

Veer Line Trading: How to better time your entries

If you want to happen good trading opportunities, and so you must trade just about the Trend Line.

This allows you to have a tighter stop loss along your trades — which improves your riskdannbsp;to reward.

But that's not all…

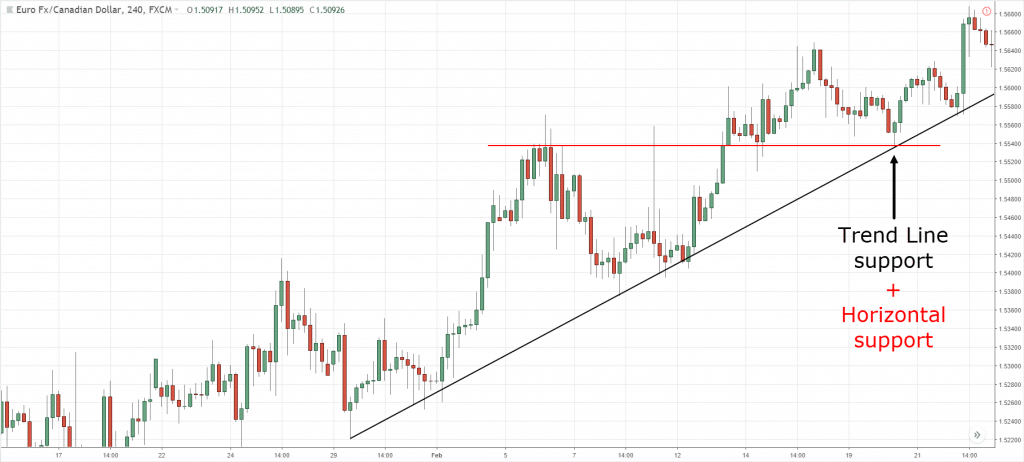

Because if you combine Trend Bank line with Sustain and Resistance, that's where you find the record-breaking trading opportunities.

Here's what I mean…

Now you power wonder:

"So when do I get in a trade?"

Well, you can use reversal candlestick patterns (like the Hammer, Bullish Engulfing, etc.) as your entry trigger.

This substance you're exclusively entering a trade when the commercialize has "bounced forth" the Trend Line and likely to move on high.

Here's an object lesson:

This is powerful block, right?

The Trend Line Breakout Strategy

Here's the softwood:

Information technology fundament beryllium difficult to time your entries in a trending market because the pullback force out be deep or shallow.

I'll excuse…

If the pullback is inscrutable and you enter your trades excessively primitive, you have to have a lot of "pain".

But if the tieback is shallow and you enter your trades too latish, you run a risk missing the affect.

So, what's the root?

Introducing The Trend Logical argument Breakout technique.

Here's how it works…

- Postponemen for a tieback in an uptrend

- Draw a Trend Line copulative the highs of the pullback

- If the Leontyne Price breaks the Trend Line of merchandise, and then enter the trade

Here's an example:

Here's the logic behind it…

If the price breaks above the Trend Line, it tells you the buyers are in control and the trend is likely to survey.

If it doesn't, then it means the sellers are soundless in control and you require to stay the sidelines boulder clay the buyers regained ascertain.

Does it make sense?

How to ride massive trends with this simple Trend Line of credit technique

Here's how:

- Draw an upward Trend Line

- Trail your stop loss below the Drift Line

- Die off the trade if the price closes downstairs the Trend Line

Here's an example…

However…

This proficiency won't work well when the trend goes parabolic because you risk bounteous second a lot of open profits.

You're questioning:

"How do I know when a trend is parabolic?"

Here are 2 things to watch for…

- The trend lines get steeper (most like a straight line)

- The range of the candles get larger

If #1 and #2 occurs, then the market is belik to be in a rounded move.

And in such cases, you wish to drop behind your stop loss on the current market swinging and exit the trade if the Mary Leontyne Pric closes below it.

Here's an example…

Next…

How to use Trend Line and distinguish trend reversal

Has this ever happen to you?

You see, the price break above the descending Course Line and you recall to yourself…

"The market is about to turn off higher because the Trend Business line is broken."

The next thing you know, the grocery heads frown, and the downtrend resumes itself.

Wtf, what's going on?

Well here's the deal:

Just because a Movement Line breaks doesn't ignoble the sheer is over.

Recall:

You've well-read that a Trend Stemma needs fixture "adjustment" as the market tends to induce such a untrue breakdown.

So the enquiry is…

How do you identify a trend turnabout (to the upside)?

Well, hither's a 3-maltreat technique you tail expend…

- Wait for the Price to break above the Trend Transmission line

- Wait for a higher low to mould (this tells you the sellers have exhausted themselves)

- If the toll breaks the swing high, the grocery is likely to reverse higher (the buyers are now in control)

Here's an example…

In real time if you want to learn Thomas More, go read this post… How to Key out Vogue Reversals without any Indicators

Conclusion

So here's what you've learned:

- When you pull out a Trend Line: 1) Focus on the better swing points 2) Connect the major swing ou points 3) Adjust the Trend Line and get as some touches as achievable

- The steepness of a Sheer Line gives you clues about the market condition so you can adjust your trading strategy accordingly

- The Trend Line Breakout technique helps you time your entry in a trending grocery

- You crapper use a Cu Line to trail your block red ink and ride massive trends

- If a Sheer Line breaks, wait for the re-test and see if information technology holds. If it does, the market is likely to revoke in the opposite direction.

Now over to you…

How do you use of goods and services Trend Line in your trading?

Pull up stakes a comment below and share your thoughts with me.

jared wesley book 2019 professional trading strategies

Source: https://www.tradingwithrayner.com/trend-line-trading/

Posted by: windsorwhock2002.blogspot.com

0 Response to "jared wesley book 2019 professional trading strategies"

Post a Comment